85%

Reduction in customer service costs

67%

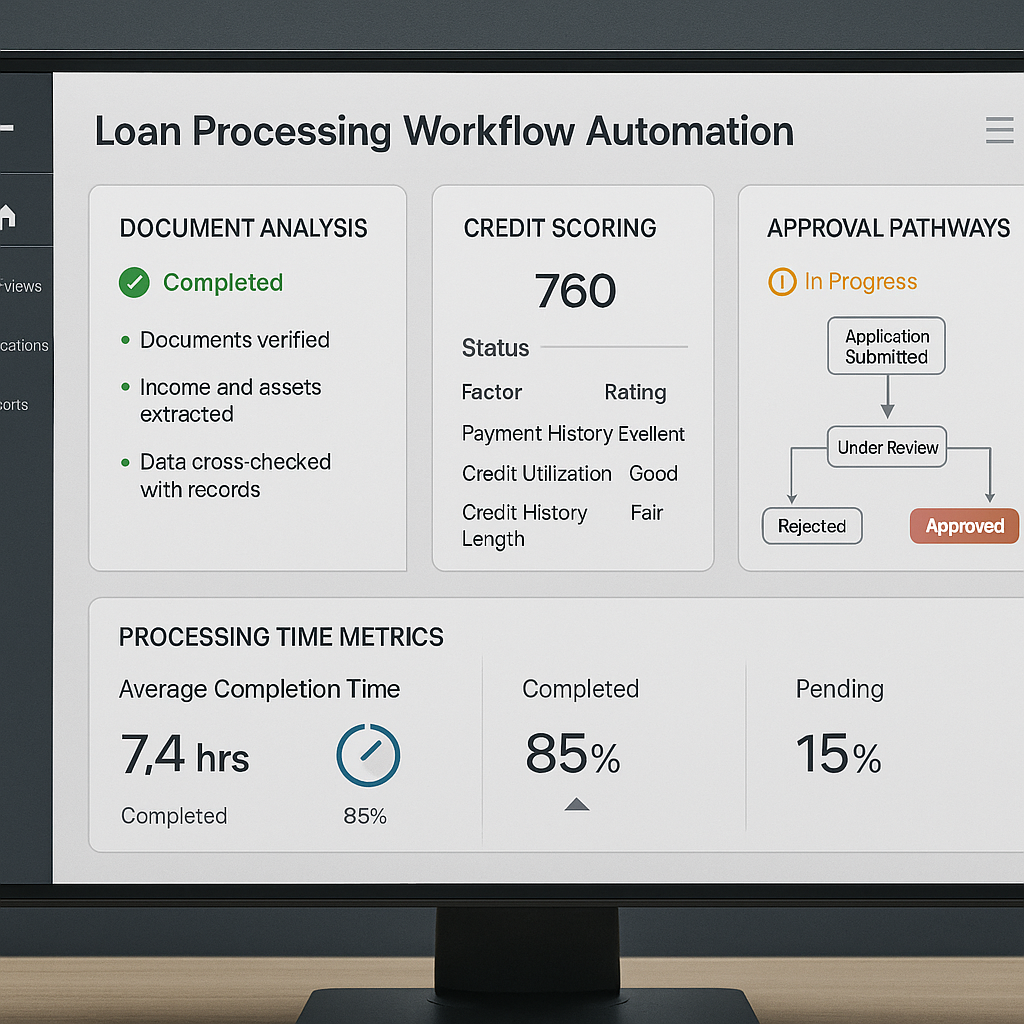

Faster loan processing times

92%

Fraud detection accuracy

3.5x

ROI on AI implementation

Financial Solutions

Our AI-powered tools help financial institutions enhance customer experience, improve security, and drive operational efficiency.

AI-Powered Customer Service

Intelligent chatbots that handle customer inquiries, account questions, and financial advice 24/7.

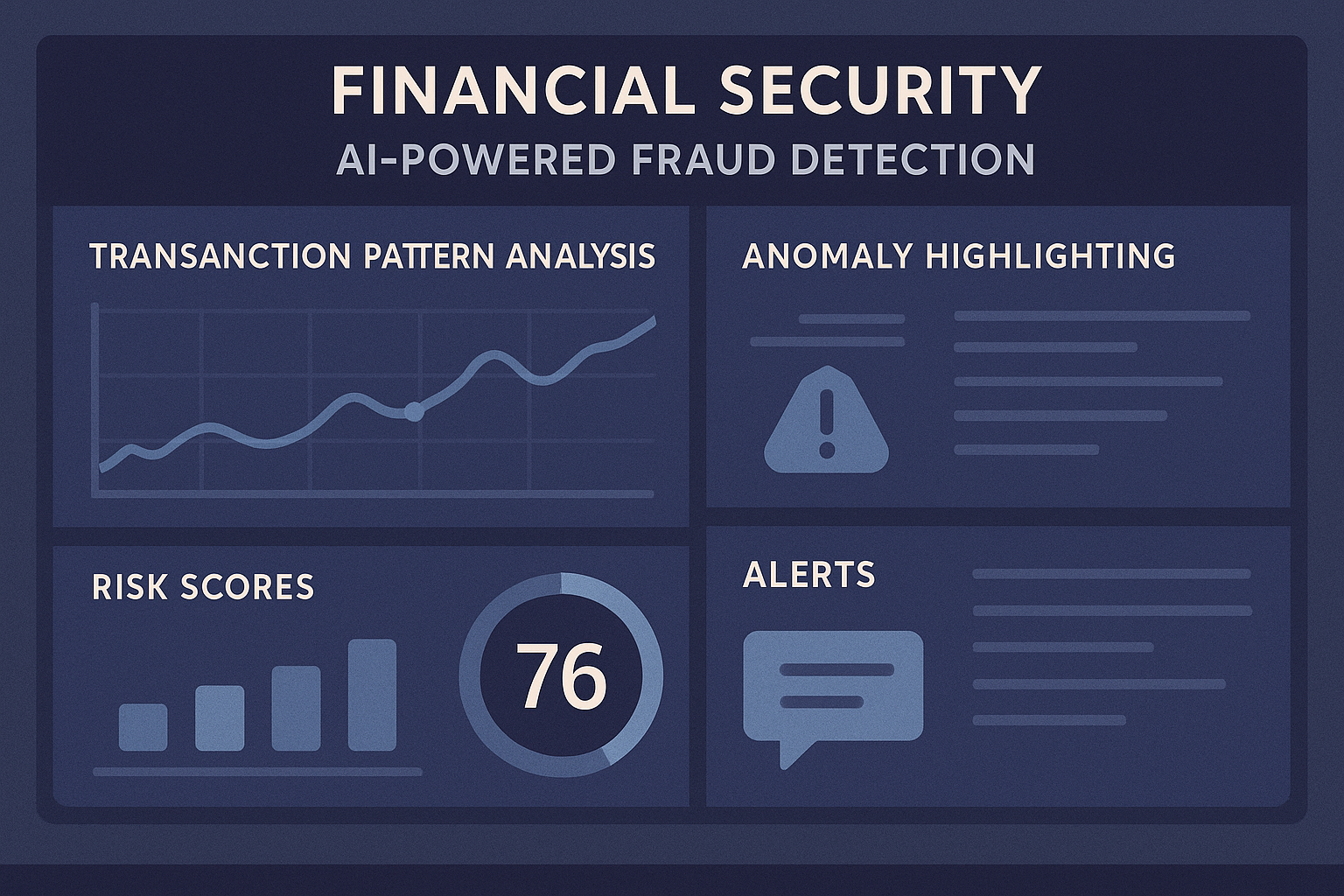

Fraud Detection & Prevention

Advanced AI systems that detect unusual patterns and potential fraud in real-time.

Personalized Financial Insights

AI-driven analysis of spending patterns, investment opportunities, and financial planning suggestions.

Automated Loan Processing

Streamline loan applications with AI that validates data, assesses risk, and accelerates approvals.

Predictive Analytics

Forecast market trends, customer behavior, and business opportunities with AI-powered analytics.

Regulatory Compliance

AI systems that monitor transactions and communications to ensure compliance with financial regulations.

How First Digital Bank Reduced Costs by 35%

First Digital Bank implemented our AI customer service and automated loan processing solutions, resulting in a 35% reduction in operational costs, 67% faster loan processing, and significant improvements in customer satisfaction scores.

What Our Clients Say

Hear from financial institutions that have transformed their operations with Imegah.

Imegah's AI solutions have transformed our customer service operations. We're handling 70% more inquiries with the same team size, and our customers love the instant responses.

Michael Thompson

Chief Digital Officer, Alliance Bank

The fraud detection capabilities are remarkable. We've seen a 43% reduction in fraud losses since implementing Imegah's AI system, with false positives down by over 60%.

Sarah Williams

Head of Security, Global Financial Services

Enterprise-Grade Security for Financial Data

Our solutions meet the strict security and compliance requirements of the financial industry, with comprehensive protections for sensitive data.

Bank-Level Encryption

AES-256 encryption for all data, both in transit and at rest.

Regulatory Compliance

Compliant with GDPR, CCPA, PCI DSS, SOX, and other financial regulations.

Regular Security Audits

SOC 2 Type II certified with continuous monitoring and regular penetration testing.

Frequently Asked Questions

Get answers to common questions about our financial industry solutions.

How does your AI ensure the security of sensitive financial data?

Our AI systems are built with security-first architecture, incorporating bank-level encryption, strict access controls, and continuous monitoring. All data processing complies with financial industry regulations, and we maintain SOC 2 Type II certification with regular third-party security audits.

Can your solutions integrate with our existing core banking systems?

Yes, our solutions are designed to integrate with major core banking platforms through secure APIs. We have pre-built connectors for systems like FIS, Fiserv, Jack Henry, and others, with the ability to develop custom integrations as needed.

How accurate is your fraud detection system?

Our fraud detection system achieves 92-95% accuracy with a very low false positive rate (under 3%). The system continuously learns from new data patterns, improving its detection capabilities over time while adapting to evolving fraud techniques.

What ROI can we expect from implementing your AI solutions?

Financial institutions typically see ROI within 6-9 months of implementation. Our clients report average cost savings of 30-40% in customer service operations, 50-70% faster processing times, and fraud reduction of 35-45%.